Breakthrough Incentive Markets

Aligning financial incentives with scientific progress to solve humanity's most urgent challenges

There must be a better way

Science today stands at a precarious crossroads. While capable of solving humanity's most crucial problems, it finds itself trapped between academic prestige-seeking and corporate profit-hunting, with public funding increasingly uncertain.

Over the past two months, there has been a slew of scrutiny and cuts to scientific funding eloquently talked about elsewhere. There are three facts that have been made abundantly clear by recent events. I think you will agree with them regardless of whether you support or oppose these recent changes:

Science has the power to solve problems that are crucial to the future of humanity.

The current methods for allocating research funding are much more focused on prestige than they are on allocating funding in as efficient and problem-focused a way as possible.

If scientific research in the United States continues to depend almost exclusively on federal funding, its future is in serious jeopardy.

The solution may be neither more lobbying for federal grants nor appealing to corporate altruism. A third path exists—one that combines democratic prioritization of important problems with market-driven resource allocation.

I am proposing a new funding methodology that answers a simple question:

What if we harnessed the same ruthlessly efficient mechanisms that drive innovation in the private sector to efficiently fund science that solves the most important problems?

Specifically this proposal uses a modified version of a well-validated method, prediction markets—proven systems for aggregating distributed knowledge—to build a new method for bringing private sector funds into science. This isn't a theoretical proposal requiring legislative action or institutional overhaul. It's a system I believe could be implemented right now.

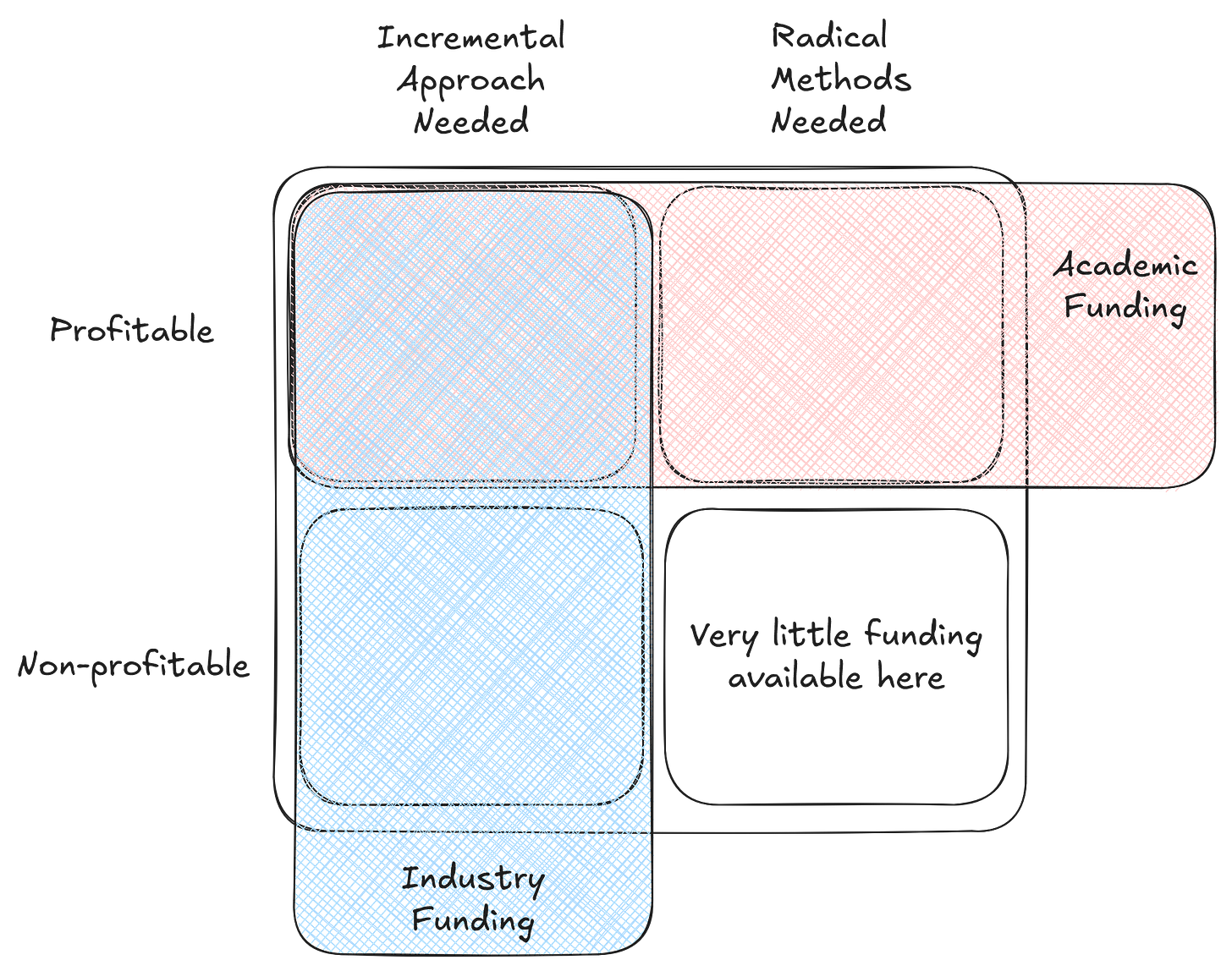

Funding for non-profitable innovative ideas falls through the cracks

Science advancement today finds itself caught between two flawed funding models–academia’s incrementalism and industry’s profit-seeking. Each of these generate problematic distortions in the research landscape. Valuable ideas languish because they’re too radical for conservative academic funding and too disconnected from profit for industry investment.

Academic funding excels at solving problems that require large amounts of slow incremental progress. The Human Genome Project is a great example of a time this approach worked. It was a massive undertaking where multiple laboratories systematically sequenced the human genome over years, checking and verifying each others results. These labs ultimately completed the project ahead of schedule and under budget through steady, distributed progress.

This bias towards incremental and conservative solutions becomes problematic when academic consensus clings to faltering hypotheses, as evidenced in Alzheimer’s research. Despite decades of disappointing clinical outcomes for treatments targeting amyloid beta plaques and promising alternative hypotheses, millions in public funding continue flowing into this approach. Grant decision-makers receive no penalty for giving funds to research that will likely yield no solutions for the problem at hand. Without market pressures, academic research can become entrenched in established paradigms.

The bureaucratic overhead of traditional academic funding creates additional inefficiencies. Small projects often aren’t worth the administrative burden of applying for grants, regardless of their potential impact. Academic metrics like citation counts and journal prestige determine status but often fail to translate knowledge into meaningful outcomes for the taxpayers funding the work. Incentives across stakeholders–researchers, funders, and the public–remain fundamentally misaligned, as research priorities are determined largely by institutional gatekeepers rather than what will most efficiently solve public needs.

Industry, meanwhile, demonstrates ruthless efficiency, but only when profit potential exists. Consider the market’s response to CRISPR gene editing technology in the early 2010s. Billions in capital flowed into applications within months, numerous biotech startups launched, and established companies quickly pivoted. Traditional gene therapy approaches that had consumed research funding for decades were rapidly deprioritized. While this efficiency drives rapid progress in commercially viable areas, the requirement for profitability creates massive blind spots. Fundamental research in mathematics, theoretical physics, and computational complexity enable enormous technological progress decades later. However they struggle to attract private capital because their payoffs are too distant and diffuse. Research on solutions for problems like drug addiction (substance use disorder) receives minimal private investment despite devastating societal impact, as those affected often lack resources to make such research profitable. Industry funding also tends to favor proprietary solutions over collaborative advancement of knowledge. Critical research areas can remain underfunded despite their importance, leaving the vulnerable behind as their problems lack viable business models.

What’s needed is a third path—a funding mechanism that combines academia’s ability to tackle big societal problems with industry’s ruthless efficiency. We need a system that aligns incentives for all stakeholders: researchers pursuing breakthroughs, funders seeking efficient solutions, and a public desiring tangible progress on important problems. This is precisely what Breakthrough Incentive Markets (BIMs) aim to accomplish.

The mechanics of BIMs

Background on prediction markets

Before diving into BIM’s, let’s understand the underlying mechanism that makes them powerful: prediction markets.

Prediction markets are financial markets where participants buy and sell contracts that pay out based on the outcome of future events. Examples include predicting election results, sports outcomes, or economic indicators. These markets have repeatedly demonstrated remarkable accuracy for three key reasons:

They aggregate diverse knowledge from many participants

They strongly incentivize accurate predictions (put your money where your mouth is)

They reward early correct predictions more than late ones

BIMs take this concept and apply it to a different problem: funding scientific breakthroughs. Instead of merely predicting outcomes, participants actively work to create them. While traditional prediction markets ask “What will happen?”, BIMs ask “How can we make this happen?”

BIMs are focused on incentivizing maximally efficient investment in research. Investors typically care about annualized return-on-investment above all else. For a BIM, final payout and initial investment are both fixed rates for any single investment. What is not fixed is the number of years before the outcome of the Research Outcome Market is reached and investors receive their payout. The shorter the time until the problem is solved, the higher the annualized return-on-investment. This means that investors can increase the value of their investment by finding and funding promising research that has a high probability of solving the problem as quickly and cheaply as possible. (More on the specific math at play here in appendix 1).

How a BIM Works

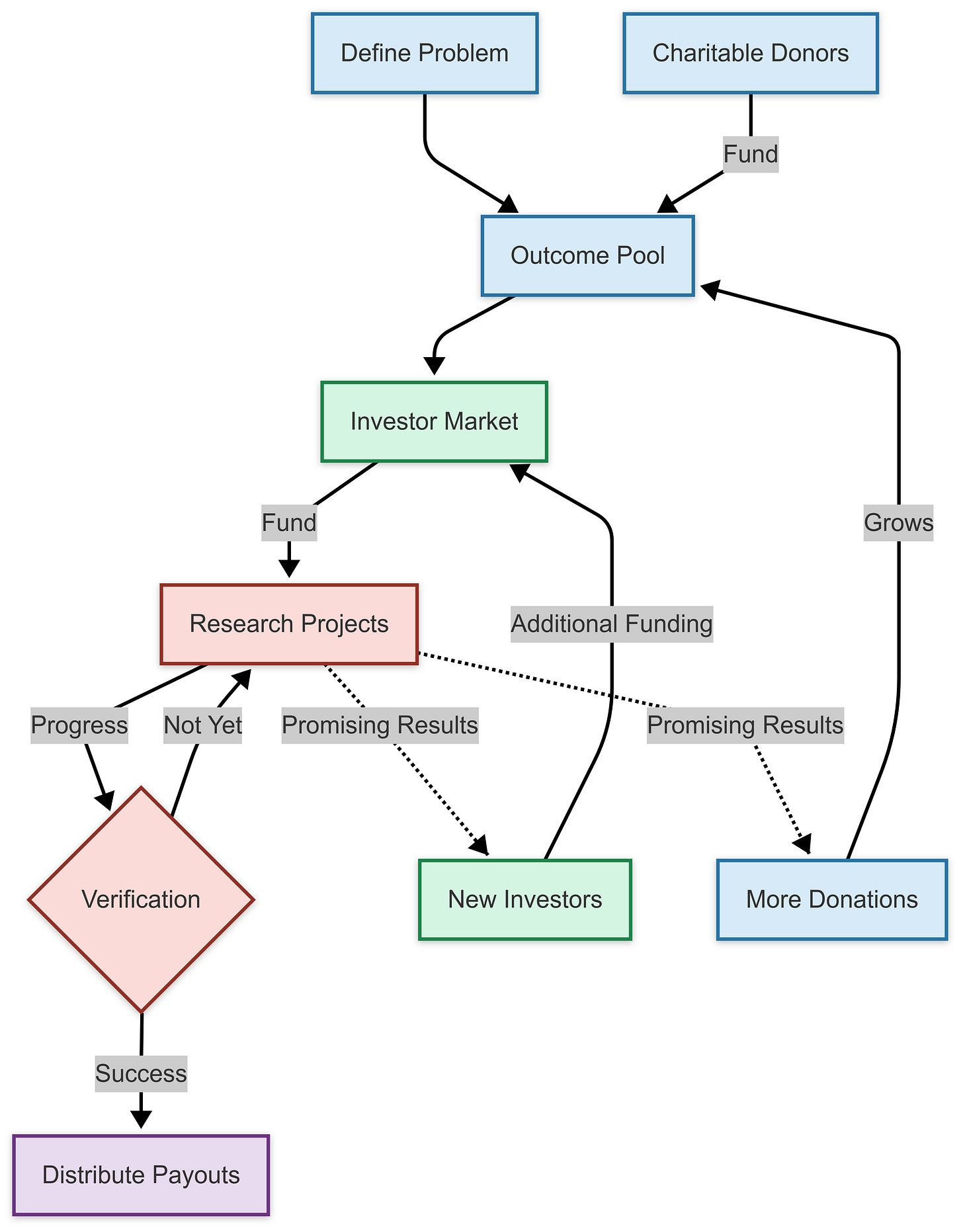

Here is how a research outcome market would work step-by-step:

Clearly Define the Problem: A clearly defined outcome with measurable success criteria (e.g., “A FDA-approved treatment that reduces Alzheimer’s cognitive decline by at least 40%”). You would also likely appoint a neutral party to determine when the criteria have been met.

Create the Outcome Pool: Establish a financial pool that pays out when the problem is solved. This pool is funded through charitable donations from individuals, communities, patient groups, and anyone who cares about solving the problem. Critically, this allows the public—not just institutions—to directly set research priorities through their donations.

Open the Market: Allow “Solution Investors” to buy positions in the market (with some minimum buy-in requirement). This ensures that solution investors have the means to fund potential solutions.

Fund Research: Solution Investors then fund research approaches they believe will increase the probability of the problem being solved—whether by their team or anyone else. Their financial incentive is to fund the projects that raise the probability of the outcome happening the most for the least amount of money.

Payout Upon Success: When the problem is solved (as verified by predetermined criteria), all investors who took positions are paid based on the size of the outcome pool when they entered the market, the size of other investments, and their investment. (More on the specific math here in appendix 1).

I discuss the specific legal mechanisms under which a Research Outcome Market could be set up in greater detail in appendix 2. The quick version is that any solution investors would almost always be qualified purchasers under the Securities Act meaning that certain laws that normally apply to markets like this would not apply. This means that there are paths to set this up legally that are not available to more standard prediction markets.

Letting Everyone Do What They Do Best

BIMs create a division of labor between three groups where each group focuses solely on what they excel at:

The Public (Contributors): Non-experts are good at identifying the high-level problems that need solving. A parent of a child with pancreatic cancer doesn’t need a PhD to know that finding a treatment matters. This system lets the public do what it does best: define priorities through their charitable contributions.

Markets and Investors: Markets excel at evaluating probabilities and allocating resources efficiently. When an approach shows promise, more capital flows to it; when an approach falters, funding redirects elsewhere. With this system, markets can do what they do best: evaluate which solutions have the highest probability of success per dollar spent.

Researchers: Scientists and innovators thrive when they can focus on deeply understanding problems and developing creative solutions. This system lets researchers do what they do best: innovate with minimal distraction from grant-writing, politicking, or conforming to institutional preferences.

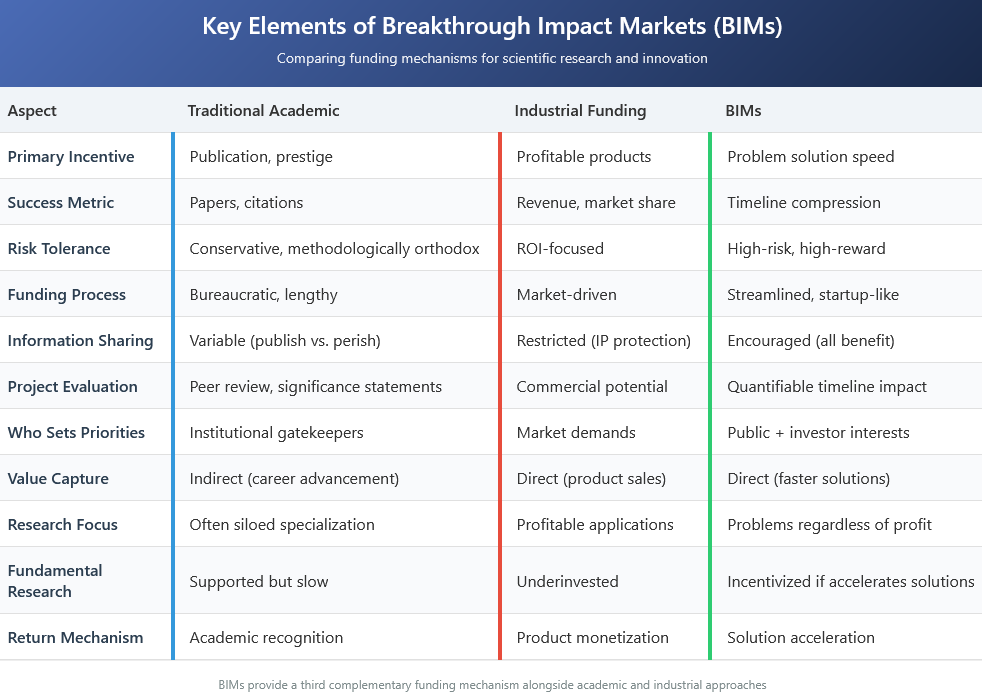

BIMs provide a helpful alternative to traditional research funding mechanisms

BIMs create a third complementary funding mechanism alongside academic and industrial funding. BIMs create financial incentives tied to solving problems themselves rather than monetizing solutions. This allows investors to capture value from public goods with distant or diffuse payoffs that traditional markets cannot accommodate. It also allows for high-risk high-reward research to take place that academic funding systems might consider too unorthodox.

BIMs incentivize speed and efficiency. For most scientific challenges, a solution will eventually emerge—what investors in these markets care about is accelerating that timeline to maximize their annualized returns. This rewards innovation over methodological orthodoxy. This approach also deincentivizes the bureaucratic overhead of traditional academic research funding. It is probable that grant applications from investors in these BIMs would be similar to startup funding with brief initial applications followed by deeper vetting for promising ideas. While conventional academic grant systems might make small funding applications not worth the bureaucratic effort, these more streamlined applications make cheap, short projects that slightly accelerate timelines viable.

BIMs require researchers to make quantifiable claims about how their work will compress timelines to solutions relative to funding requested. This replaces vague significance statements with explicit accountability for results. Individual success, for a researcher, becomes defined by solving real-world problems that affect large amounts of people as quickly as possible.

While industry funding neglects valuable non-profitable areas, BIMs enable investment in solving important problems regardless of commercial potential. Since investors profit when ANY solution succeeds, the system encourages information sharing and collaboration. This incentive for collaboration also creates an incentive for more fundamental research. If one group does some fundamental research that allows another group to come up with a solution to the problem more quickly, the funders of the first group still benefit from a better return on investment. Finally, demonstrations of progress compress expected timelines as the market goes on, attracting more investment precisely when scaling becomes necessary.

The public directly influences which problems get solved through their contributions to outcome pools, adding democratic input to research priorities rather than leaving these decisions exclusively to institutional gatekeepers or profit motivations. BIMs don’t replace academic or industrial research—they provide a vital third option that channels resources toward radical innovations in neglected yet crucial areas.

The Third Model: An Aspirational Narrative

So far things have remained very conceptual. I wanted to write a very short short story to show a “potential history” of what a world with BIMs might look like. The following scenario explores how Breakthrough Incentive Markets might operate alongside traditional scientific funding mechanisms to address antimicrobial resistance. I am not an expert in antibiotics, this is just my best attempt at writing about them based on my current understanding.

In early 2026, the CDC's biennial report on antimicrobial resistance documented an acceleration of treatment failures across multiple bacterial pathogens, with untreatable gram-negative infections emerging in hospitals nationwide. Traditional responses followed familiar patterns—the NIH allocated $120 million over five years for basic research, while pharmaceutical investment remained minimal, focusing only on modifications to existing drug classes.

Against this backdrop, the Antimicrobial Breakthrough Trust launched with a clear objective: development of a novel antimicrobial effective against pan-resistant gram-negative bacteria. The initial outcome pool totaled $115 million, funded by hospital systems, public health foundations, and private citizens directly affected by treatment failures.

Dr. Maya Chen at Northwestern University had spent eight years studying bacterial quorum sensing mechanisms through NIH grants. Her approach showed promise in laboratory studies but faced translational hurdles. Her recent grant application for advancing this work toward development had been rejected, with reviewers requesting additional mechanistic studies.

In early 2027, after learning about the BIM, Dr. Chen received $3.7 million from investors who had taken positions in the market. Her funding application was unlike any one she had filled out before. She started with sending a 500 word summary of her research idea in, along with a mathematical estimate on how much this would decrease the time to solution. After several progressively smaller interview rounds, with investors, and consultants that were brought in by investors to tell sound science from bad, Dr. Chen recieved the award.

By 2029, Dr. Chen's research operated in three distinct but interconnected streams. Her NIH-funded academic laboratory continued investigating fundamental cellular biology. Her pharmaceutical consulting work helped improve existing antibiotics through targeted modifications, prioritizing predictable outcomes with clear commercial potential. The BIM-funded program operated under different constraints—with no pressure to publish or build a commercial product line, the team focused exclusively on creating a functional therapeutic as rapidly as possible.

The BIM created unique collaboration dynamics. When Dr. Chen's team encountered delivery challenges, investors introduced her to Dr. Wei Lin's group at UC San Diego, which had developed targeted bacteriophage technology under separate BIM funding. The two teams recognized complementarity between their approaches.

Where academic collaborations typically formed around publication opportunities and industry partnerships around commercial potential, this relationship formed around the mathematical calculation that combining approaches might significantly accelerate the timeline to a viable antimicrobial. The investors supported rapid information once they were persauded that their financial returns improved if the breakthrough occurred sooner.

By 2031, the work evolved into a hybrid approach combining engineered bacteriophages as delivery vehicles for quorum-sensing disruptors, protected by specialized nanoparticle technology. The approach allowed precise targeting of pathogenic bacteria while leaving beneficial microbiome members unaffected.

As the technology progressed, boundaries between funding streams blurred. Fundamental questions generated publications from Dr. Chen's academic laboratory. Some delivery system components attracted pharmaceutical attention for broader applications. The BIM funding continued supporting the core therapeutic development that remained too risky for traditional investment.

In late 2033, the combined approach received FDA approval for treatment of previously untreatable infections. The verification committee confirmed the breakthrough criteria had been met, triggering distribution of the outcome pool—which had grown to $380 million—to investors based on their timing and investment level.

Early investors received approximately 24% annualized returns—competitive though not extraordinary by venture capital standards, but remarkable given the public health impact and previous lack of financial incentives in this area. More importantly researchers around the world had sucessfully coordinated to make progress on a very large problem with potentially devastating impact.

Appendix 1: Mathematical Framework behind the incentives in a BIM

Key Incentive Mechanisms

Basic Parameters

For any Research Outcome Market, we define:

Share Pricing and Payout Calculations

When an investor contributes Iᵢ at time tᵢ, they purchase shares that entitle them to a fixed portion of the payout pool as it existed at that time:

Share price: The price per share is set by the fund based on current pool size and investment levels. Fund managers are given significant amounts of shares at the beginning, that only vest when the outcome is reached, to align incentives.

Shares received:

Payout share:

Final payout:

Annualized return:

This structure provides investors with certainty about their final payout amount (Pᵢ) at the time of investment. The only unknown variable affecting their return is when the problem will be solved (T).

Incentive 1: Speed and Efficiency

The annualized return formula shows why investors are incentivized to minimize time-to-solution:

As T decreases, the exponent (1/(T−tᵢ)) increases, dramatically increasing returns.

Example: Accelerating Research Timeline

Consider two potential research investments:

Investment A: $2M with expected solution in 10 years

Investment B: $3M with expected solution in 7 years

With a payout pool of $20M:

Return for A:

Return for B:

Despite the higher investment amount, Investment B yields higher returns because it compresses the timeline more efficiently. This creates a natural selection mechanism for approaches that solve problems fastest, not just cheapest.

Incentive 2: Viability of Small Projects

Small, promising projects become viable when they can measurably compress timelines.

Example: Small but Effective Investment

Imagine a research market with:

Current payout pool: $10M

Total investments: $1M

Expected solution timeline: 8 years

A researcher proposes a small $50K project that could accelerate the timeline by 6 months.

Without this project:

With this project:

The return increases despite the additional investment, making this small project mathematically worthwhile. Traditional grant systems might reject this project as too small, but Research Outcome Markets naturally accommodate any size project that efficiently compresses timelines.

When Is It Worth Investing?

For an investor with a minimum acceptable return rminrmin, an investment is worthwhile when:

Where:

Inew is the proposed new investment

Tnew is the expected time to solution after the investment

Solving for the minimum timeline compression required:

This formula directly answers when an investment is worthwhile: when it compresses the expected solution timeline sufficiently relative to its cost.

Investment Decision Example

An investor considering a $500K investment with:

Current pool: $15M

Current total investment: $3M

Current expected timeline: 9 years

Minimum acceptable return: 20%

For this investment to be worthwhile, it must compress the timeline to:

So if this $500K investment can accelerate the timeline by at least 0.95 years (approximately 11.4 months), it meets the investor’s minimum return requirement.

Incentive 3: Information Sharing and Collaboration

Since investors profit when ANY solution succeeds, not just their own specific approach, they’re incentivized to share information.

Example: Collaboration Benefit

Consider two competing research teams, each with promising partial solutions:

Team A has approach with 30% chance of success in 6 years

Team B has approach with 25% chance of success in 7 years

If they don’t collaborate:

If they share information and combine approaches:

New combined approach: 60% chance of success in 5 years

Expected solution time:

\(Expected\ solution\ time=0.6×5 + 0.4×(\text{longer}) \approx 7\ years\)

This timeline compression from ~10 to ~7 years dramatically increases returns for all investors:

This creates a powerful mathematical incentive for information sharing, even among competitors.

Incentive 4: Demonstrating Progress Attracts More Funding

As research shows promise, the payout pool tends to grow, benefiting early investors.

Example: Progress Demonstration Effect

Initial market conditions:

Payout pool at t=0: $5M

Initial investment: $500K

Expected timeline: 10 years

After 2 years, the research team demonstrates significant progress, causing:

Payout pool grows to $15M

New investors contribute additional $2M

Timeline estimate improves to 6 more years (8 total)

For early investors:

This creates strong incentives for transparency and public demonstration of progress, as it attracts more contributions to the payout pool and compresses timelines, both benefiting early investors.

Appendix 2: Legal Implementation Through Breakthrough Incentive Trusts

Note: I am not a lawyer, I have just done a very large amount of research on my own. It is very possible I am misunderstanding several things but this is my best attempt to outline a legal structure for BIMs'. This does not constitute legal advice. Any implementation of these concepts would require consultation with qualified legal counsel.

The Trust Structure

BIMs could be funded through a Breakthrough Incentive Trust (BIT). For each BIM, a separate irrevocable trust would be established under South Dakota law.

The trust instrument would precisely define the scientific breakthrough being incentivized with clear, measurable, and objective success criteria. An independent committee of qualified experts would be chosen to verify achievement of the outcome according to these predetermined criteria.

The BIT uses a dual-pool financial arrangement. The Charitable Outcome Pool consists of donated funds committed to rewarding achievement of the breakthrough, while the Investment Pool comprises positions taken by qualified purchasers who seek to profit from the eventual breakthrough. These pools remain strictly segregated within the trust structure.

To distinguish this structure from wagering, qualified purchasers would be required to fund some amount of relevant research. This requirement would be implemented with substantial flexibility regarding both amount and specific research approaches. A small annual fee, typically 0.5-1% of the Investment Pool, would fund ongoing operations, verification processes, and administration.

Why South Dakota?

South Dakota offers several advantages that make it the optimal jurisdiction for BITs. Unlike most states, South Dakota permits truly perpetual trusts, which is critical for long-term scientific challenges that might require sustained incentives over multiple generations of researchers.

South Dakota law also allows for separation of trustee functions through its directed trust provisions. The state also provides stronger privacy protections than most jurisdictions, absence of a state income tax, and robust shields against potential creditor claims.

Most importantly, South Dakota has developed a sophisticated trust services industry capable of administering complex arrangements.

The Single-Purpose 501(c)(3)

For tax-deductible charitable contributions, a single-purpose 501(c)(3) scientific research organization would work alongside the trust. This organization would be formed with articles of incorporation explicitly defining its exclusive purpose as advancing a specific scientific breakthrough by providing outcome-based incentive funding. Its bylaws would contain detailed provisions regarding the organization's commitment to transfer funds to the trust upon verification of the breakthrough.

A scientific advisory board comprising recognized experts in the relevant field would validate the breakthrough's significance and public value for 501(c)(3) requirement purposes. Most critically, a binding legal agreement between the 501(c)(3) and the trust would specify the conditions and procedures for fund transfer upon breakthrough verification.

This structure is defensible under existing IRS guidance for scientific research organizations, particularly Revenue Ruling 76-296. This ruling establishes that scientific research organizations qualify for 501(c)(3) status when their research benefits the public rather than private interests, makes results available on a nondiscriminatory basis, and advances scientific knowledge. The X Prize Foundation, disease-specific research foundations, and scientific prize-granting institutions already recognized as 501(c)(3) entities could be used as precedence.

To ensure reliable fund flow to the trust upon breakthrough verification, several safeguards would be implemented. All charitable contributions would be accepted as legally restricted funds designated exclusively for the breakthrough incentive, creating legal obligations to use the funds only for their designated purpose. The organization would execute binding legal agreements obligating fund transfer upon verification.

Governance controls would include supermajority requirements for any purpose modification and representation from the trust on the organization's board.

Qualified Purchaser Limitation

Participation in the Investment Pool would be limited to qualified purchasers as defined under Section 2(a)(51) of the Investment Company Act. This generally includes individuals with at least $5 million in investments or entities with at least $25 million in investments.

The most significant benefit is the exemption provided under Section 3(c)(7) of the Investment Company Act, which substantially reduces regulatory requirements that would otherwise apply. Qualified purchasers are legally presumed to possess sufficient financial sophistication to evaluate complex investments, reducing concerns about investor protection that might otherwise arise with novel investment structures. Arrangements limited to qualified purchasers face fewer regulatory hurdles due to this presumed sophistication, enabling greater flexibility in structure and operations.

Operational Mechanics

The operational flow of a Breakthrough Incentive Trust would begin with the establishment of both the trust and the companion 501(c)(3) with appropriate governance structures. The 501(c)(3) would then accept tax-deductible contributions designated for the breakthrough incentive, building the Charitable Outcome Pool over time.

Qualified purchasers would take positions in the market through contributions to the Investment Pool, establishing their proportional claim on the eventual outcome payment. These investors would independently fund research they believe will advance the breakthrough, with complete discretion regarding approaches and amounts.

When achievement of the breakthrough is claimed, the independent verification committee would determine whether the predetermined criteria have been met, applying objective standards established in the trust instrument. Upon verification, the 501(c)(3) would transfer funds to the trust pursuant to its legal obligations, and the trustee would distribute to investors according to predetermined formulas based on their proportional stake and timing of investment.

Other paths

In my research I found a few other potential legal mechanisms to realize a BIM, although I didn’t end up researching them deeply when I found out about the trust mechanism. Among these would be a modified version of social impact bonds. Another option would be to use a series LLC with more conventional ownership shares as opposed to a trust.